Quontic Money Market Account ( jump to Quontic Bank account details ») Otherwise, you may not earn competitive interest, and have to pay a $10 monthly service fee.

What to look out for: You'll need $1,000 to open a money market account with CFG and maintain it.

Why it stands out: CFG offers a competitive interest rates on its money market account. CFG Bank High Yield Money Market Account ( jump to CFG Bank account details ») It's also worth noting that interest compounds monthly, while many competitors' rates compound daily, giving you the opportunity to build more wealth. What to look out for: You must set up monthly direct deposits of at least $500 and sign up for digital statements to qualify for a competitive rate.

#MONEY MARKET ACCOUNT PLUS#

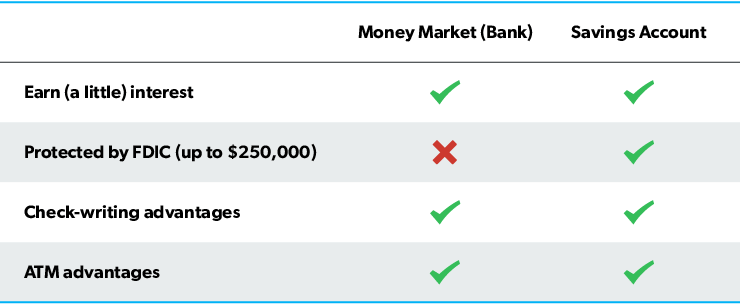

Affinity Plus also provides you with both paper checks and an ATM card, giving you easy access to your savings. If your account balance stays under $25,000, you'll keep earning the highest rate possible. Why it stands out: This is a reverse-tiered account that pays a higher rate for lower balances. Affinity Plus Federal Credit Union Superior Money Market Account ( jump to Affinity Plus Federal Credit Union account details ») The account also doesn't have a debit card or ATM card which means you might have limited access to your account. What to look out for: You may start with a low balance and earn a high rate, but if your account balance grows substantially, you could end up earning less than you would with a different company. Rate: Premier Members Credit Union's reverse-tiered rates are as follows: Premier Members also doesn't require a minimum balance, and it includes check-writing privileges. Why it stands out: While some money market accounts offer higher rates for higher balances, Premier Members Credit Union takes the opposite approach - it rewards people who have lower balances with higher rates. Premier Members Credit Union Money Market Account ( jump to Premier Members Credit Union account details » ) You can make payments from your account digitally through sites such as Zelle and PayPal, but it might be inconvenient to not be able to write a check, pay with a card, or withdraw money from an ATM. What to look out for: The money market account doesn't include check writing or debit/ATM card access.

#MONEY MARKET ACCOUNT FREE#

You can link your CIT Bank money market account with PayPal and Zelle to make payments.ĬIT Bank is also offering a free one-year Amazon Prime members if you meet the requirements listed here. Why it stands out: With CIT Bank, you'll earn the same rate regardless of how much money is in your account, and there's no minimum balance requirement. CIT Bank Money Market Account ( jump to CIT account details ») But you can find banks that refund more money. On the plus side, Synchrony reimburses up to $5 per month in out-of-network ATM fees. What to look out for: There's fees for out-of-network ATM withdrawals. Why it stands out: Synchrony doesn't have a minimum opening deposit, and the bank sends you both an ATM card and paper check. (Ally may waive this fee during the COVID-19 pandemic, though.) Synchrony Money Market Account ( jump to Synchrony account details ») What to look out for: If you make more than six withdrawals per month, you'll pay a $10 fee. The bank reimburses up to $10 per month in fees charged by out-of-network ATMs. Why it stands out: You can get paper checks and a debit card to make purchases when you open a money market account with Ally, and there's no minimum deposit. Ally Money Market Account ( jump to Ally account details ») What to look out for: There's no debit card or ATM card included. Sallie Mae also sends paper checks for you to access your money. Why it stands out: Sallie Mae pays a competitive rate, and the bank doesn't require an opening deposit.

0 kommentar(er)

0 kommentar(er)